Why tokenizing businesses beats tokenizing assets

The IPO market is closed for the “middle class” of business. Tokenized loyalty is the new way to unlock their capital.

For years, the crypto industry pretended everything was a “utility token” to avoid regulation. This held the industry back.

With the Clarity Act and the new administration policies and regulations, the industry is finally embracing the “security token” (or RWA) model. Selling tokens as “rights to revenue/equity” instead of “access to the platform” brings in institutional capital that couldn’t touch the grey market.

And while RWA narratives focus on static assets like gold or real estate, tokenizing real estate is a nightmare of heterogeneity. One square meter in a Hilton is not equal to one square meter in a Marriott; it doesn’t scale.

The more revolutionary model is the tokenization of business value flow — a hybrid between equity and a programmable loyalty system.

The airline miles analogy

During the pandemic in 2020, analysts valued United Airlines’ loyalty program, MileagePlus, at approximately $22 billion. At the same time, the airline’s total market capitalization dropped significantly, falling to as low as around $12 billion. This proves that the “loyalty layer” holds value independently of an airline’s physical assets and operations.

Now imagine if airline miles weren’t just for flights but were tradable, liquid assets that appreciated as the airline’s revenue grew. That is the new model of business tokenization.

The “equity hybrid”

It’s an asset that sits between a stock and a loyalty point. It circulates inside the business (used for payments/discounts) but trades outside the business (secondary market value). Customer uses the token to buy services (flights/upgrades) at a discount; investor holds the token because they believe the airline’s network is growing.

This isn’t just for airlines. This is the solution for the “middle class” of business — high-growth SMEs that are too big for angel investors but too small for an IPO.

Since 2000, the regulatory cost of going public has skyrocketed. According to CNBC, the median age of a company going public has risen from 5 years in 1999 to over 13 years today, cutting out normal investors from the growth cycle.

Tokenized business flow solves this. Let’s look at the “coffee shop” example:

Instead of a punch card (10th coffee free), a coffee chain issues a token.

- Customer: Buys tokens to lock in cheaper coffee prices forever (hedging inflation).

- Investor: Buys tokens because they see the chain opening 5 new locations.

This approach democratizes the “Starbucks bank” model. (Starbucks currently holds 1.7 billion dollars in unredeemed gift card float — essentially an interest-free loan from customers.) Tokenization allows smaller businesses to raise that same capital directly from their community, bypassing banks entirely.

With the help of self-executing agreements, where tokens automatically distribute dividends, it can be taken even further. Now it’s not just a discount token, but a programmable asset. The smart contract is coded to automatically airdrop a “dividend” in stablecoins or store credit every time the coffee shop hits a revenue milestone, blurring the line between “loyalty points” and “performance bonds.”

The shift from static to dynamic asset tokenization

We are sure that the “Static Asset Tokenization” (wrapping a gold bar or a square meter of real estate) will underperform compared to “Dynamic Business Tokenization” (wrapping the economic output and loyalty of a company). This business flow wins for several reasons:

Scalability

- Real Estate: Hard to scale. Every building needs a new appraisal and new legal wrapper.

- Business Flow: Easy to scale. Revenue is homogeneous. $1 of revenue in a logistics company looks the same as $1 of revenue in an e-commerce store.

The “Burn” Mechanism

Unlike a stock, a hybrid token has a deflationary pressure. If the business succeeds, tokens are consumed (burned) for services, reducing supply and potentially driving up the price for holders.

Example: Look at the performance of BNB (a utility/equity hybrid with burn mechanics) vs. a standard bank stock. The hybrid model captures value faster because it incentivizes users to become investors, providing a multitude of benefits for the BNB token holders on the Binance platform.

Other cases of dynamic asset tokenization:

Intellectual property. IP generates revenue streams via licensing and royalties. For a mid-sized software company or a media studio, their biggest asset is their IP, not their building. Tokenizing a future revenue stream from author’s rights or a software license turns “dead” IP into active working capital. Platforms like Royal have already proven this by allowing artists to sell tokenized streaming rights directly to fans, bypassing record labels.

Private credit. It is hard for smaller investors to lend to businesses seeking loans outside of traditional banks. Tokenization helps break down these investments into smaller portions. It opens up opportunities for individuals to invest in private credit and helps companies get funding, democratizing access to capital.

Patents (DeSci). Think of a biotech firm that owns a patent for a new medical device but lacks the cash to manufacture it. They tokenize a 20% claim on future licensing royalties. This is the model used by Molecule, a protocol that helps researchers mint ‘IP-NFTs.’ The token represents a “revenue share agreement”, so every time a large manufacturer pays to use the patent, a percentage flows to the token holders.

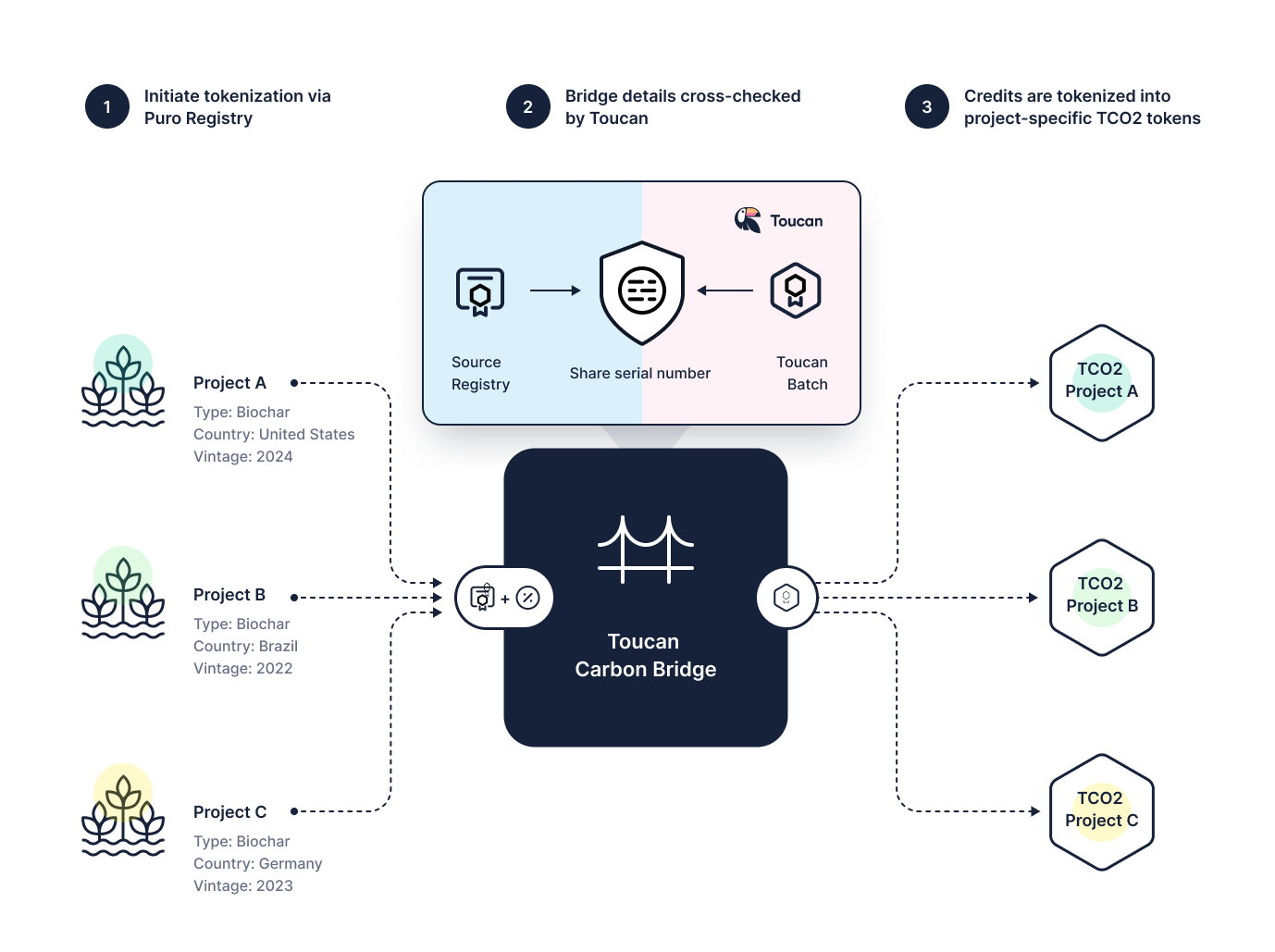

Carbon credits. Corporations meeting net-zero goals need verified offsets, but the market is slow. And for a landowner preserving a rainforest, the value is locked in the trees. Protocols like Toucan have already bridged millions of tonnes of carbon credits on-chain.

Tokenization lets the landowner turn their carbon capture potential for the next 10 years into tokens. Corporations buy these tokens to offset emissions, and the token is “burned” once claimed.

What’s in it for you?

Founders should think ‘How do I tokenize my customer behavior?’ instead of ‘How do I tokenize my equity?’ Equity brings regulation and passive investors. Tokenized loyalty brings active users who act like investors. It turns your customer acquisition cost (CAC) into a capital raise.

Investors should look at cash flow on chain, not square feet on chain. The alpha is in tokens that represent a growing business’s revenue or service economy, not static brick-and-mortar.

Tokenization is creating an ecosystem of more liquid, accessible, transparent and efficient assets beyond traditional commodities. It is a fundamental shift in how finance works, that brings a whole new level of possibilities.

Oleg Ivanov, COO & Co-founder, SecondLane