Digital asset treasuries as a new capital playbook

The quiet revolution at the intersection of traditional finance and the crypto realm is no longer quiet. Once confined to individual HODLers, digital assets are now anchoring corporate balance sheets, injecting new blood into capital formation.

We are witnessing the rise of Digital Asset Treasury (DAT) companies, which are publicly traded entities that acquire and manage digital assets as a core strategic function. Pioneered by Michael Saylor’s MicroStrategy, this playbook is now being replicated globally.

DATs offer unprecedented access and yield opportunities, helping institutional capital flow into digital assets. Yet, they demand a deep understanding of new risk vectors and a disciplined approach.

What it is: DATs as bridges to trillions

DATs are the industrialists of the digital age. They are active builders and breeders of their holdings, ambitious in compounding their treasure. The “why” behind their existence is simple: they are bridges, purpose-built to channel capital into a new asset class.

Their primary value lies as compliant gateways for the “big boys” – institutional allocators like pension funds, endowments, and family offices whose mandates prohibit direct crypto exposure. DATs offer a regulated, auditable, equity-based proxy, unlocking capital previously locked out.

This new investment product is enabled by regulatory arbitrage: the difference between direct digital asset ownership rules and public equity investment rules. Flexible capital structures that include common equity, preferred shares, and convertible bonds help DATs segment the market to attract diverse capital with different risk appetites.

Strategy, the pioneer in the DAT model, is specifically going after capital that isn’t able to hold Bitcoin as an asset directly on its balance sheets: bond traders, the fixed income guys, and other groups of capital that aren’t necessarily people on a TD Ameritrade or Charles Schwab app. Those capital reserves are in the trillions of dollars. Obviously, that has accrued effects on price given the fixed supply.

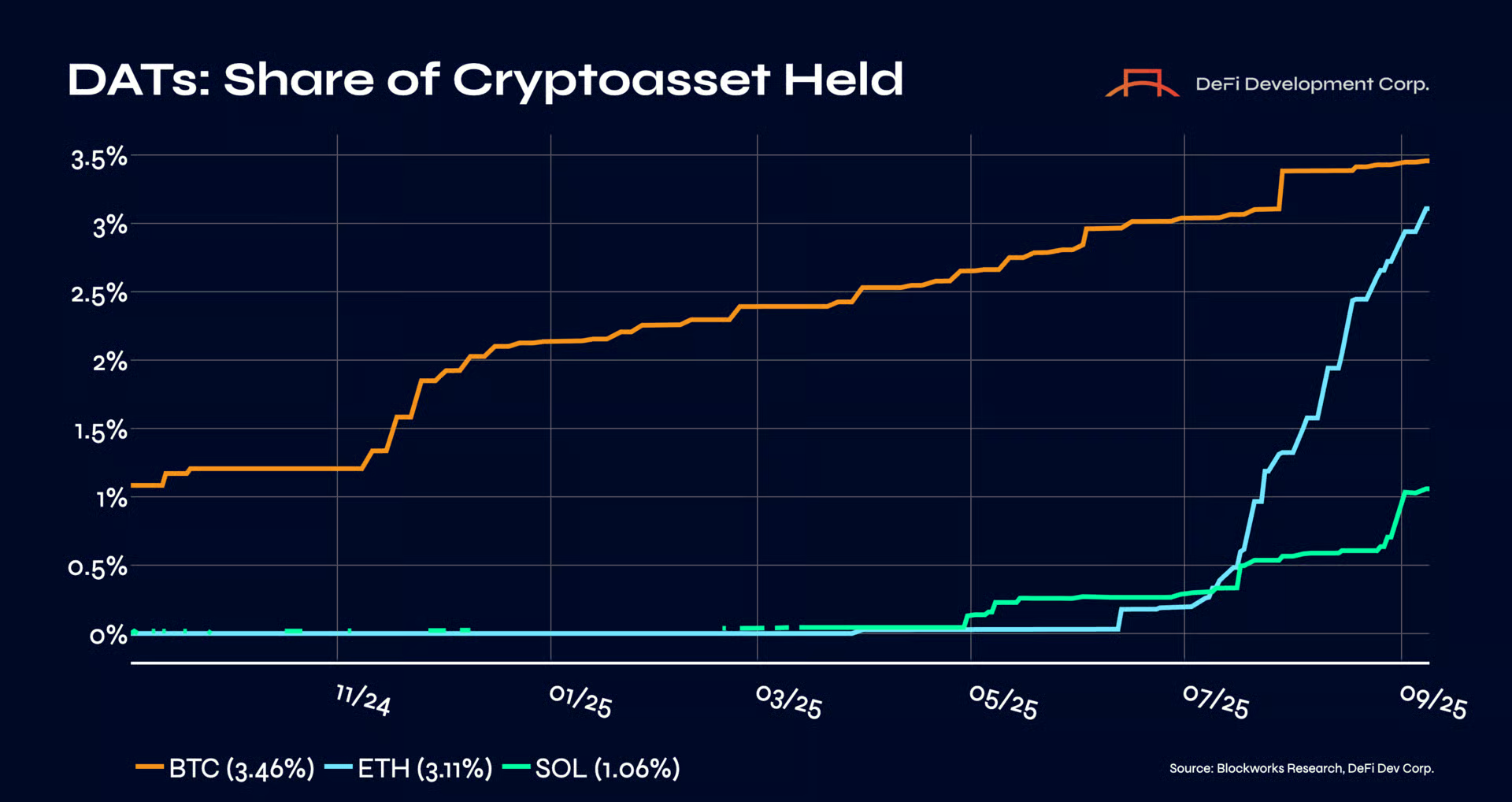

The scale is undeniable: over $100 billion in digital assets, dominating Bitcoin and Ethereum holdings but rapidly diversifying into Solana, XRP, BNB, and beyond.

Why are DATs big right now: new capital playbooks

2025 brings more clarity about how companies can participate in the blockchain sphere. With a GENIUS act that regulates stablecoins, the CLARITY act that is about to be passed in the coming months, and the fact that the US Government is holding Bitcoin in the Treasury and has an agenda to accumulate Bitcoin and hold it as an asset like other commodities. All of this gives a clear signal that industry is allowed, it’s regulated, and you can be a player in the space — and DATs make it so easy.

At the heart of every successful DAT lies a self-reinforcing financial flywheel. It’s the Saylor playbook, refined and deployed: a persistent equity premium on DAT shares leads to more capital, which in turn leads to more underlying digital asset acquisition, further cementing that premium.

Now, how exactly do DATs raise the capital?

At-the-market (ATM) offerings are the preferred weapon. New shares, issued incrementally at a premium, allow for what’s termed “accretive dilution” – each dollar raised buys more crypto per share than it dilutes.

Convertible notes offer another lever: low-cost debt with high conversion premiums that transform market optimism into non-dilutive liquidity for asset acquisition.

For newer or smaller players, private investments in public equity (PIPEs) bring rapid capital infusion, though with inherent dilution and future supply overhang risks. The issuance of perpetual preferred stock is also a tool for long-term capital without common equity dilution.

What do DATs provide?

Remember that they’re also “breeders”? DATs actively monetize accumulated digital assets.

A lot of these companies hire asset managers to monetize the underlying assets, which can be done through a variety of ways. For proof-of-stake assets like Solana (with its ~7.9% native yield) and Ethereum (~4%), native staking provides a foundational income stream. And then if you go further out in the risk curve, there are opportunities to restake that, and juice that yield even further. The asset manager could participate in lending, liquidity pools, structured products like covered calls or BTC-based ELS, and turn passive holdings into active revenue generators.

Some DATs are even engaging in predatory tactics by acquiring smaller DATs trading at a discount. Ultimately, these entities are becoming ecosystem participants, active validators, DAO voters, and infrastructure providers, shaping the very protocols they invest in. They’re evolving into “balance-sheet hedge funds” of the DeFi.

Potential risk vectors

The DAT model poses inherent structural risks that demand due diligence and a sober understanding of market mechanics.

Reflexive premium trap

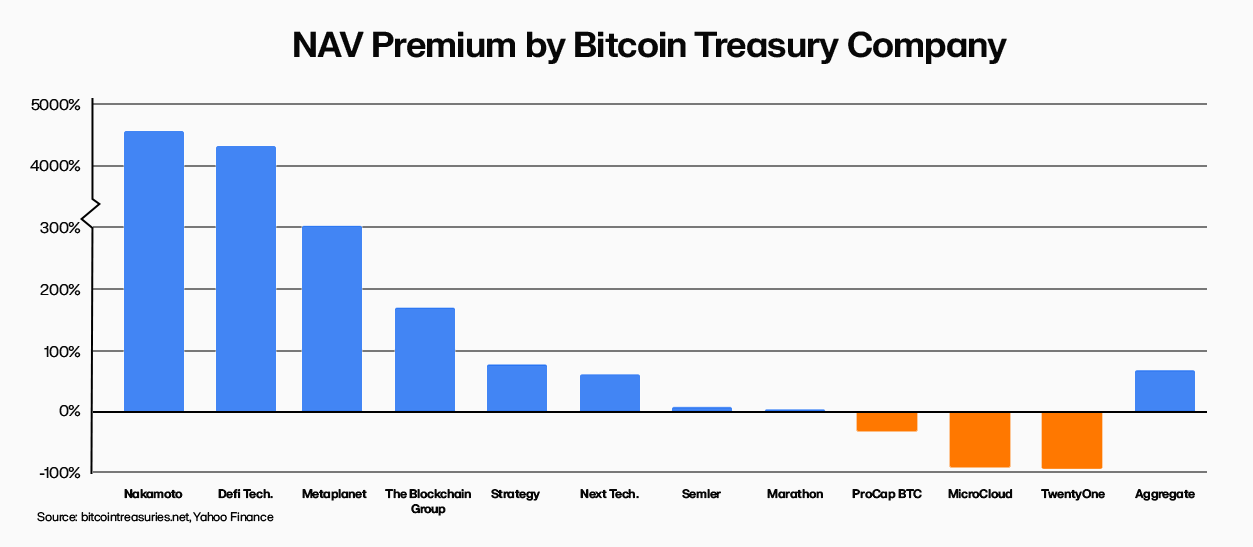

DATs critically depend on a persistent equity premium to their Net Asset Value (NAV). This premium often reflects hype and perceived future growth, rather than current profitability. During the collapse of Grayscale Bitcoin Trust, investors got stuck with a loss, even though Bitcoin’s price didn’t fall as much, simply due to a lack of redemption mechanisms. Many new DATs lack ways for investors to “cash out” their share of the crypto, mirroring this vulnerability.

Market volatility amplification

DATs, particularly those focused on a single asset, act as “structured leverage products” on their underlying digital assets. Strategy, for instance, typically exhibits around 1.6x the volatility of Bitcoin. This means amplified alpha in a bull run, but magnified losses in a downturn.

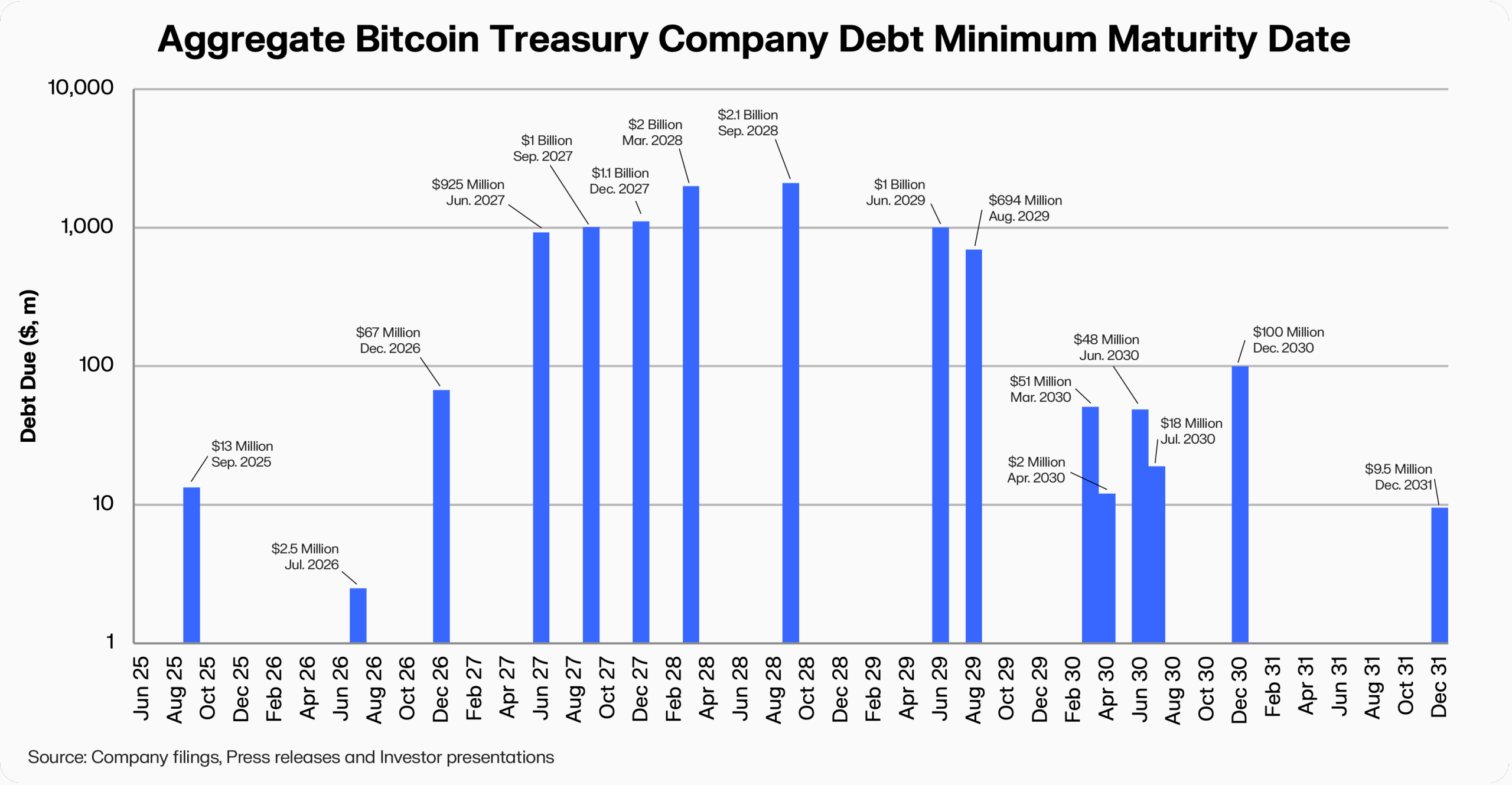

Debt walls

Strategy’s $8.2 billion debt maturity wall by 2032, far exceeding its current cash reserves, is a ticking clock. If their stock isn’t high enough to convert that debt into shares by then, it will force tough choices between selling assets (which would be a huge psychological blow to the market, as Saylor always says he won’t sell) or taking on costly new debt.

Shelf companies liabilities

The”shelf companies” used to speed up ATM access are often a minefield of legal baggage that can bite back at any time.

There’s a lot of risk when you purchase a shelf company. Essentially, it is something that is already listed: probably a failed business, with a list of assets and liabilities. Here’s the thing with liabilities, though: you don’t know what they are until you do. This company may have outstanding claims or claims that haven’t been brought forward yet. Imagine if you’re an investor, a creditor, or a former employee, you feel wronged in any way, and you hear that this company is turning into a DAT. You just start licking your chops because now there’s an asset to go after. And that’s exactly what happens. So when you’re doing diligence on shelf companies as an investor in DAT companies, you want to know exactly what you’re facing, because if you make mistakes here, it’s going to ruin your entire strategy. We’ve already seen this.

Operational vulnerabilities

Crypto-native risks – hacks, smart contract exploits – pose much bigger problems in the face of public company regulatory compliance. The initial funding of some altcoin-DATs, where seed capital might come from insiders or DAOs rather than fresh capital, raises “castle in the air” concerns. The dual scrutiny and evolving laws of straddling TradFi and DeFi complicate things even further.

Is there value beyond the speculations?

The core challenge for DATs is existential: they must evolve from a “holding model” to a “utilization model.” The premium must be justified by recurring revenue and transform into a multiple that reflects fundamental business value, not just speculative demand. Indeed, many DATs are now observed trading below their NAV multiple, a trend anticipated to continue as their underlying business models often prove too basic to generate sustained demand for the stock amidst increasing competition post-listing.

A way for DATs to become sustainable enterprises lies in diverse monetization strategies. These include off-chain and on-chain asset management and implementing new business models: leveraging assets as collateral for cash-generating businesses, operating derivatives markets (as with Hyperliquid’s HYPE token), or institutionalizing token utility within broader financial systems (like Saylor’s vision for Bitcoin-backed mortgages).

The “early winners” in this arena will be defined by several non-negotiable factors: strong leaders who can balance crypto-native insight with TradFi governance and investor relations (think Saylor or Tom Lee); jurisdictional advantage of using favorable regulatory and capital market conditions; productive asset use that actively generates yield and participates in ecosystems; and control in form of transparent disclosures, fair value accounting, and reporting on-chain activity.

Navigating the new current

While the market buzzes with the promise of DATs, risks and intricacies remain unaddressed or simply not understood by many.

Few truly appreciate the hidden liabilities of shelf companies, the true cost of debt walls, or the nuance of market psychology beyond the premiums. The DATs aren’t about what assets are held, but how these entities are structured and managed, and the strategic foresight of the leadership teams guiding their evolution.

The transition from a speculative premium to a sustainable multiple is a treacherous journey. Differentiating between them and collaborating with the right players requires firsthand experience navigating both private equity and digital assets, combined with an extensive network and insights gained from the “trenches” of these sectors. Distinguishing between speculations and genuine long-term value in DATs is an area where information asymmetry reigns.

For investors seeking to participate in the DAT market, this often translates into the need to access investment opportunities via a proven network and to structure Special Purpose Vehicles (SPVs) to participate effectively (find out how we at SecondLane approach SPVs in our next blogs.) This is particularly vital given that many DAT deals are highly illiquid and often trade only within a small pool of buyers 30-60 days after issuance.

Deep market engagement and nuanced structuring are indispensable for anyone hoping to profit in this calculated pursuit of capital’s future.

Nick Cote, CEO; Oleg Ivanov, COO SecondLane