How the great liquidity crunch is reshaping private markets

Venture capital has a distribution problem. For limited partners (LPs) across the globe, the days of predictable capital calls followed by timely returns are receding into memory. We are now in the era of the great liquidity freeze, a systemic issue where capital is trapped in aging funds, stalling the entire innovation cycle for LPs, general partners (GPs), and founders alike.

According to the PitchBook-NVCA Venture Monitor, exit activity, though occasionally flickering with life, remains stubbornly depressed. Recent fund vintages are showing historically low DPI ratios, a clear signal that the traditional 10-year fund model is straining at its very foundations under the pressure of a stalled exit market. Indeed, analysts now anticipate a relapse in exit activity, leading sponsors to hold onto portfolio companies for even longer, swelling the ranks of companies held in funds six to nine years old.

We are now in the era of the great liquidity freeze, a systemic issue where capital is trapped in aging funds, stalling the entire innovation cycle for LPs, GPs, and founders.

This is a structural failure. The ZIRP-era valuation hangover has left GPs in an “extend and pretend” limbo, unable to exit positions without marking down assets. Simultaneously, the IPO window remains largely shut for many tech darlings like Stripe or Reddit, which saw a modest post-IPO performance, and M&A activity is throttled by heightened antitrust scrutiny of Big Tech. The public sagas of companies like Klarna, whose valuation plummeted by over 85%, or Checkout.com’s 78% internal valuation cut, underscore the painful reality of this re-pricing. While GPs continue to collect management fees, LPs are left with paper gains and no cash to reinvest.

This creates a “liquidity crunch” with cascading downstream effects for new investments and broader market liquidity. Paradoxically, over $1 trillion in venture dry powder remains undeployed globally, yet new deployments are slow, highlighting the systemic paralysis. The entire system, built on a flywheel of distributions and reinvestment, has ground to a halt.

Where there’s a will, there’s a way – and it’s secondary markets

If the primary exits are frozen, where does liquidity come from? The answer lies in leveraging the secondary market not just as a venue for one-off trades, but as a strategic tool for active portfolio management. This allows GPs to “take some chips off the table” from their winners, returning capital to LPs without waiting for a full exit. Returning capital faster allows LPs to reinvest, creating a powerful liquidity flywheel.

Secondaries are no longer a one-off trade. They are becoming the only viable path to liquidity, turning paper gains into capital.

Secondaries also provide an escape hatch for LPs who need to sell their fund stakes directly. The demand for these assets is relentless; for many institutional players, the secondary market is now the only viable path to gain exposure to elite, de-risked companies like OpenAI or SpaceX.

A new breed of asset manager is emerging to capitalize on this dislocation, operating with a liquidity-first mandate. The success of this model is driven by a disciplined focus on asset selection. The primary targets are “distressed assets” and “special situations.” Consider the FTX estate liquidations, where premium assets like Solana were acquired at a significant discount to their spot price.

This focus on near-term liquidity events allows for incredibly rapid cycles. As a practical example, a recent $11M raise for assets like TIA and BNB was executed in 48 hours, with assets distributed to investors in days, not years. A lightning-fast acceleration against the ponderous clockwork of traditional VC’s multi-year lockups.

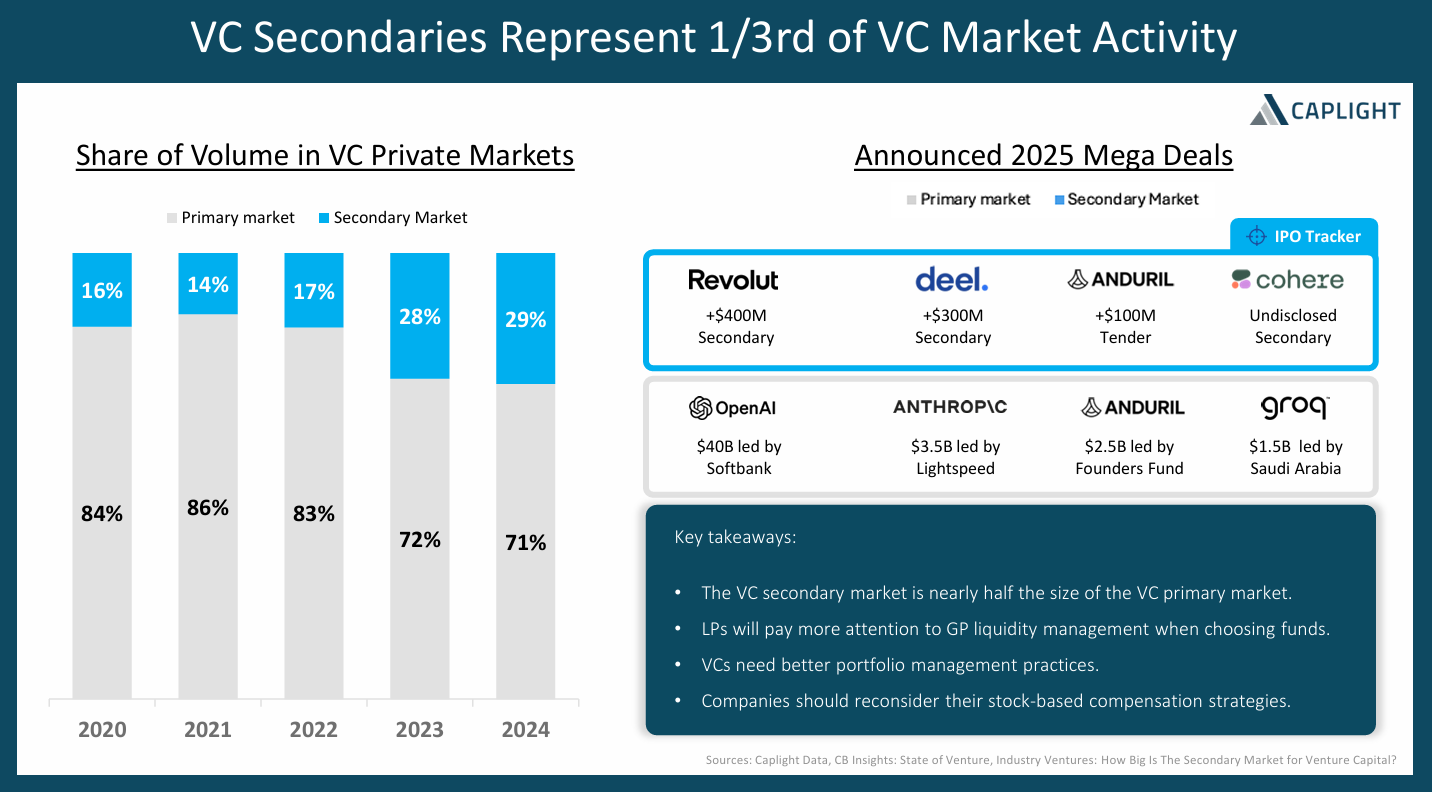

The ultimate proof is in the numbers: according to Caplight, the volume of the secondary market is now almost ⅓ of total VC market deal activity.

The key is in the knowledge

Executing this liquidity-first strategy requires an informational edge. In a market defined by opacity, how do you value an asset like OpenAI when there’s no public market where shares freely trade? The only reference point comes from what others were willing to pay in prior rounds or discreet secondary transactions. This is where the most effective new managers operate with an “oracle effect,” using proprietary data from an affiliated brokerage to gain an advantage.

By aggregating a constant stream of non-public bids and asks, they get a real-time sense of the private market’s true sentiment. In practice, this means receiving inquiries from both buyers and sellers, and as those inquiries are aggregated, a clearer view of the market emerges. By concentrating these signals, they effectively become the market maker.

This creates a powerful, data-driven feedback loop for identifying mispricings. For example, if someone offers a 20% discount on asset X, the value of that offer can only be assessed with the right data. If the data shows that others are willing to buy at just a 10% discount, then the 20% discount clearly represents a good deal to take. This informational asymmetry is what allows for confident decision-making.

Once an opportunity is identified, the deal is structured through Special Purpose Vehicles (SPVs). These provide operational efficiency, since sellers like foundations or founders prefer dealing with a single source rather than multiple fragmented parties. SPVs also create capital efficiency, allowing smaller checks to be pooled into a larger vehicle. Rolling commitments up into an SPV can quickly generate meaningful purchasing power, giving investors access to high-minimum institutional deals they otherwise couldn’t enter on their own.

A promising model

Looking ahead, the evolution of this model points toward true liquid alternatives. The future state could involve the tokenization of LP stakes themselves. Imagine acquiring an asset with a five-year lock at an 80% discount. Fast forward one year, the project looks stronger, and the asset is likely trading at a higher implied value. Even if the lock remains, the LP token could be sold at a higher price than the original purchase, allowing the investor to exit early and still realize gains.

The market for tokenized illiquid assets is growing; securities, real estate, debt instruments, commodities, etc. Firms like Ondo Finance BlackRock, bringing U.S. Treasuries on-chain, demonstrate the tangible mechanics of this transformation.

This transforms traditionally illiquid, multi-year commitments into tradable assets with their own secondary market. For an LP, this is a revolutionary shift. Instead of being trapped for the entire fund lifecycle, they now have an exit ramp that allows them to realize gains and redeploy capital.

A gateway into VC secondaries

The current market dynamics demand a different playbook. What we are building at SecondLane Capital is designed around that reality: a liquidity-first approach that combines proprietary market data with structuring expertise to address illiquidity head-on. By focusing on distressed assets and special situations in the secondary markets, we aim to demonstrate how a more agile, data-driven model can become a cornerstone of the private market ecosystem going forward.

Nick Cote, CEO & Co-Founder SecondLane