Web 3 secondary market report, May 2024

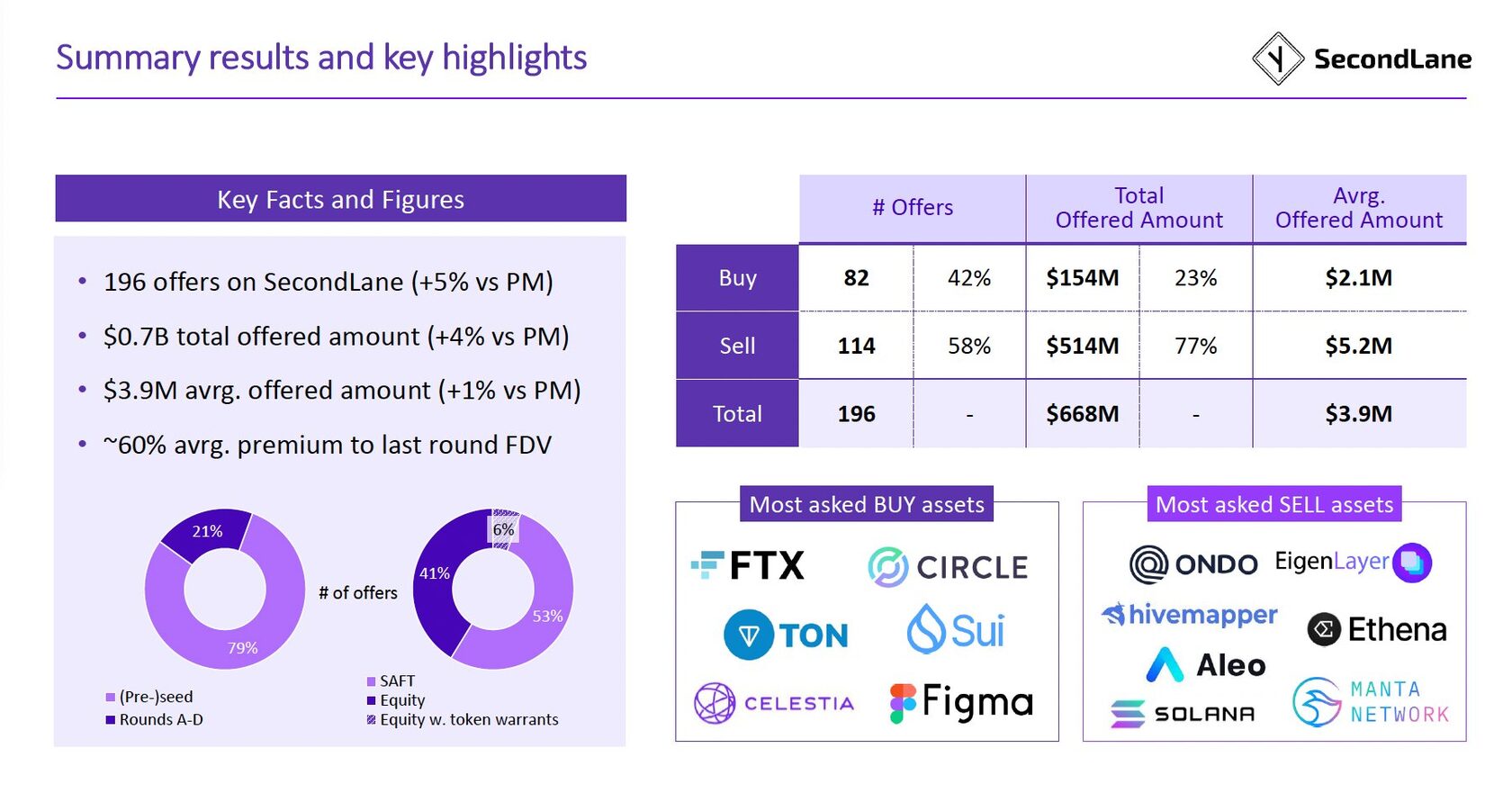

- $668M in order book value in May 2024

- $3.9M avg offered amount

- 60% average premium to last round FDVs

- top projects: FTX claims, Circle, TON, Sui, Celestia, EigenLayer, Solana, Athena, Aleo, Manta, Figma

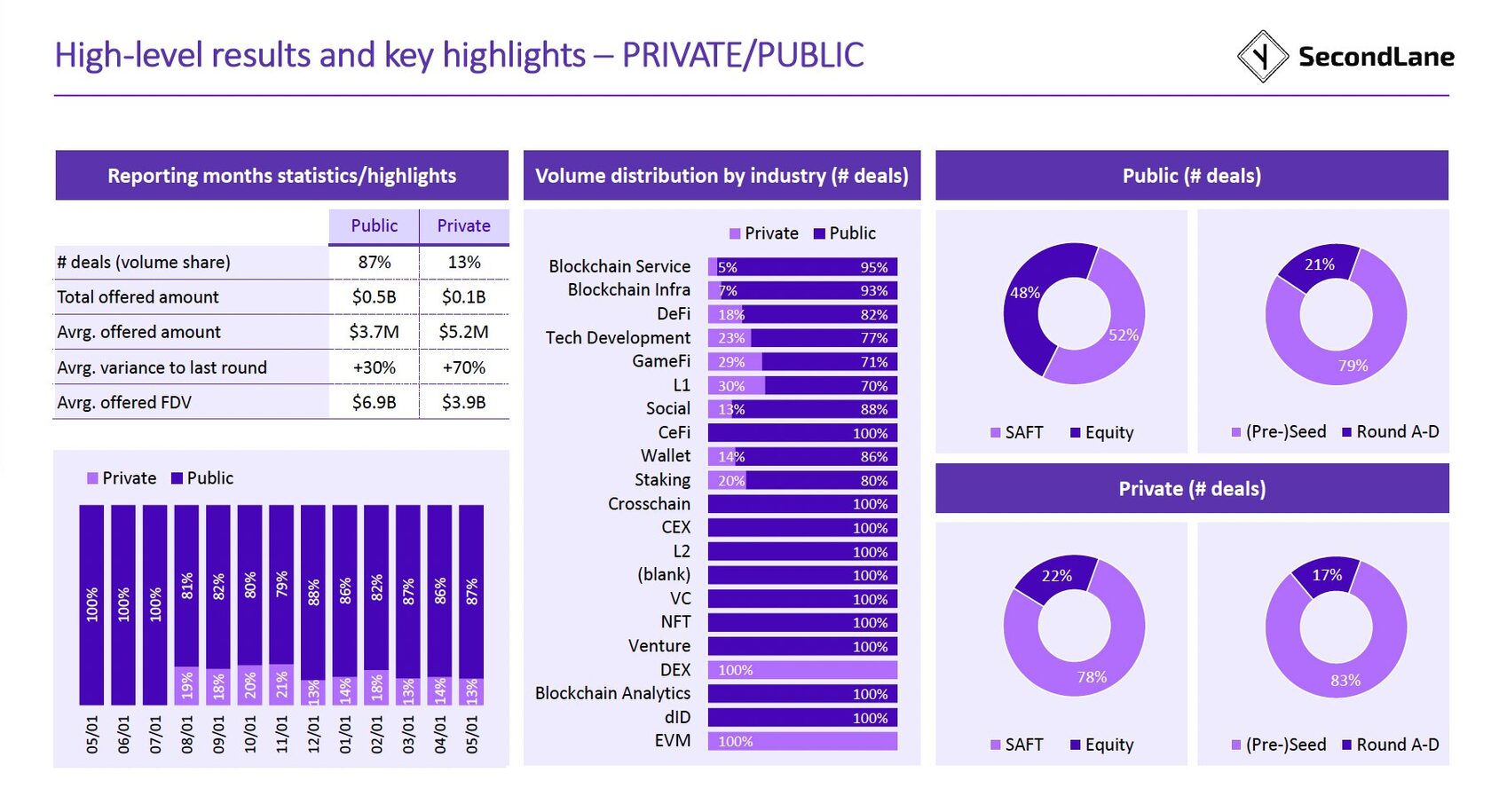

- 56% SAFT and 44% equity deals

- 79% (Pre-)Seed, 21% Rounds A-D

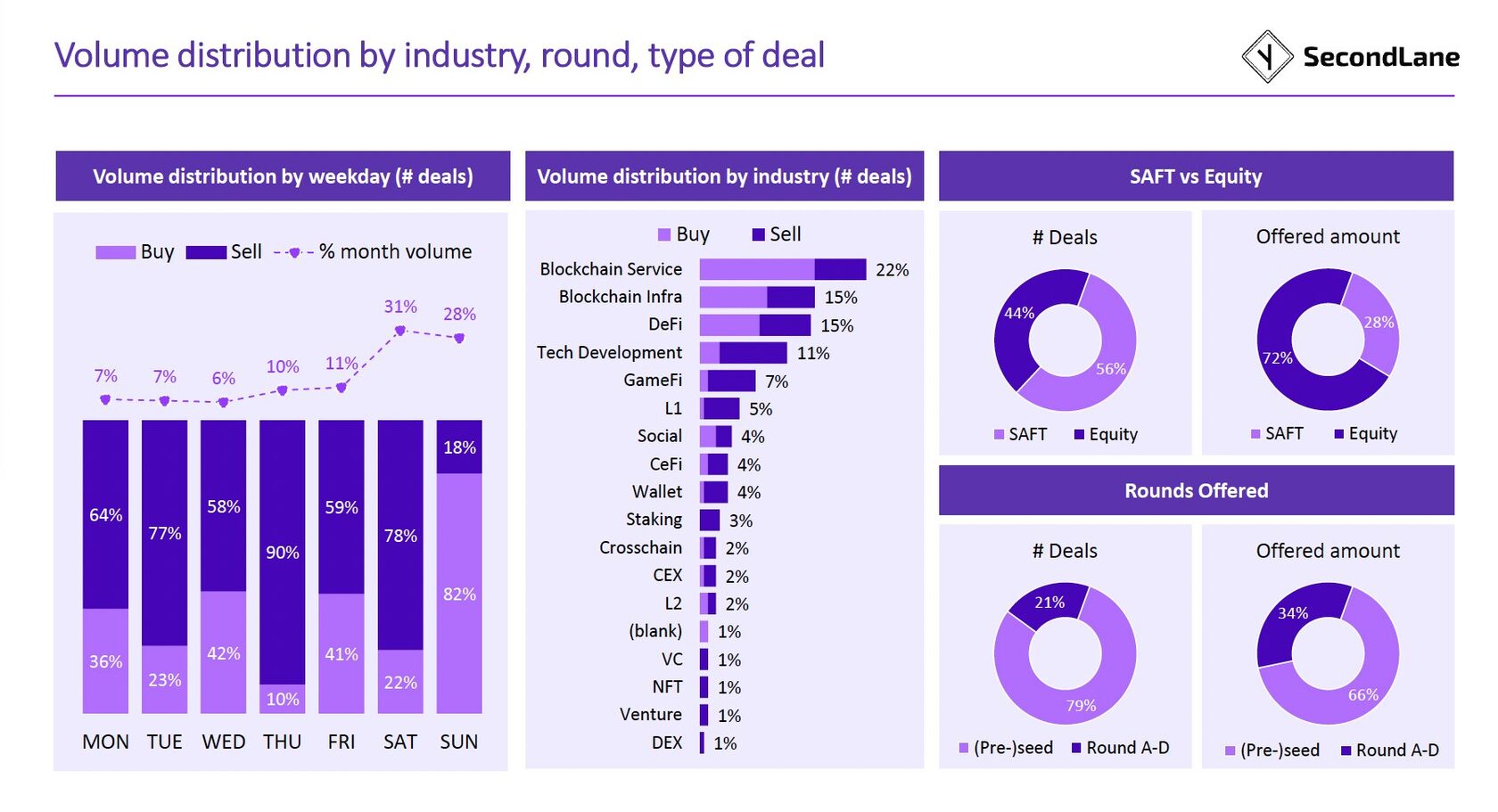

- 73% of deals attributed to 5 sectors: blockchain services, infrastructure, DeFi, tech development, GameFi

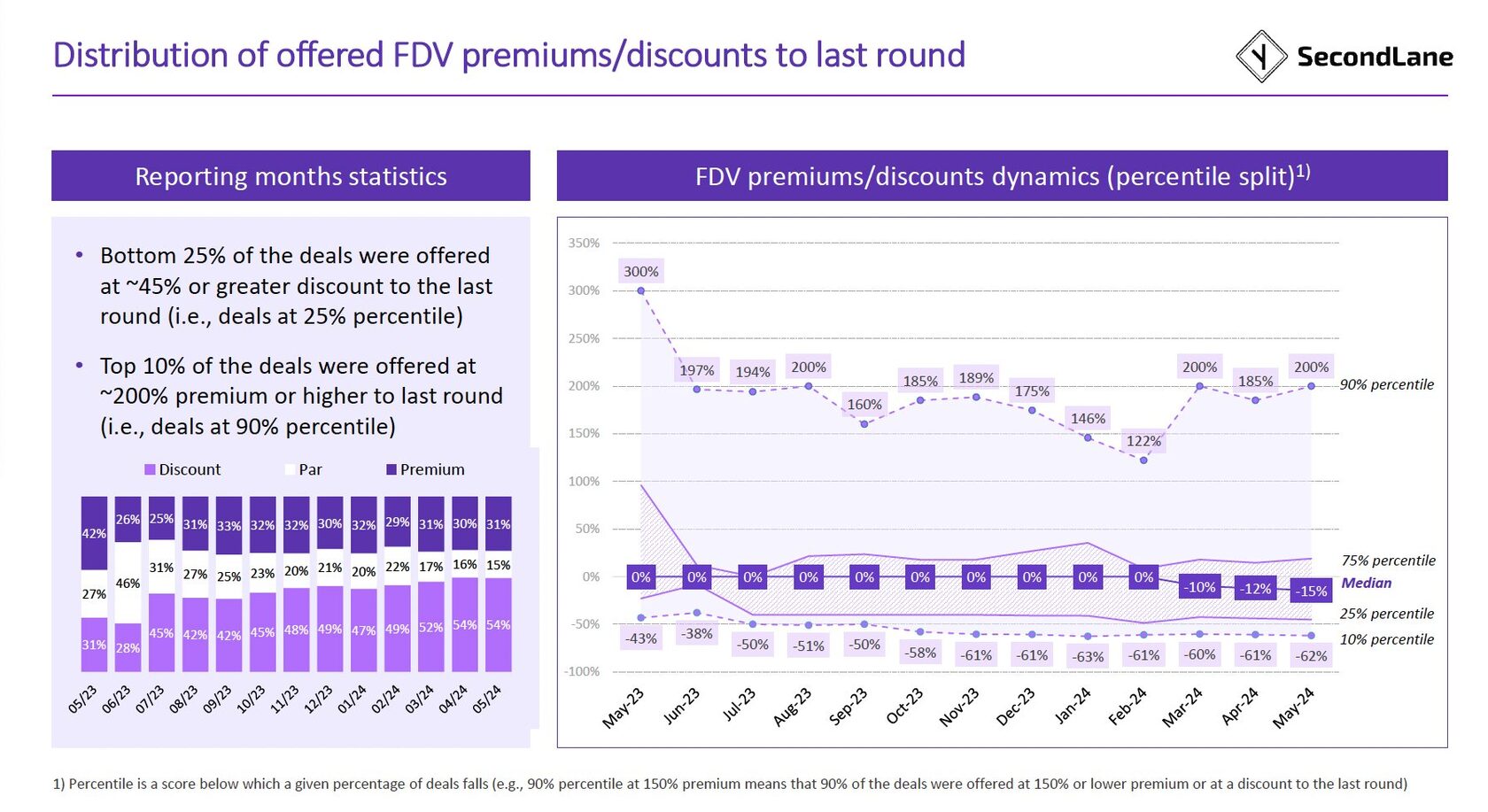

- 1% increase in deals with premiums to previous rounds

- same amount of discounted offers: 54% of deals in May came with discount, 15% at par, and 31% with premium to previous round

- 15% median discount to previous round on all deals in May

- larger premiums on hot deals: top 10% of deals offered at 200% premium or higher to previous round (vs 185% last month)

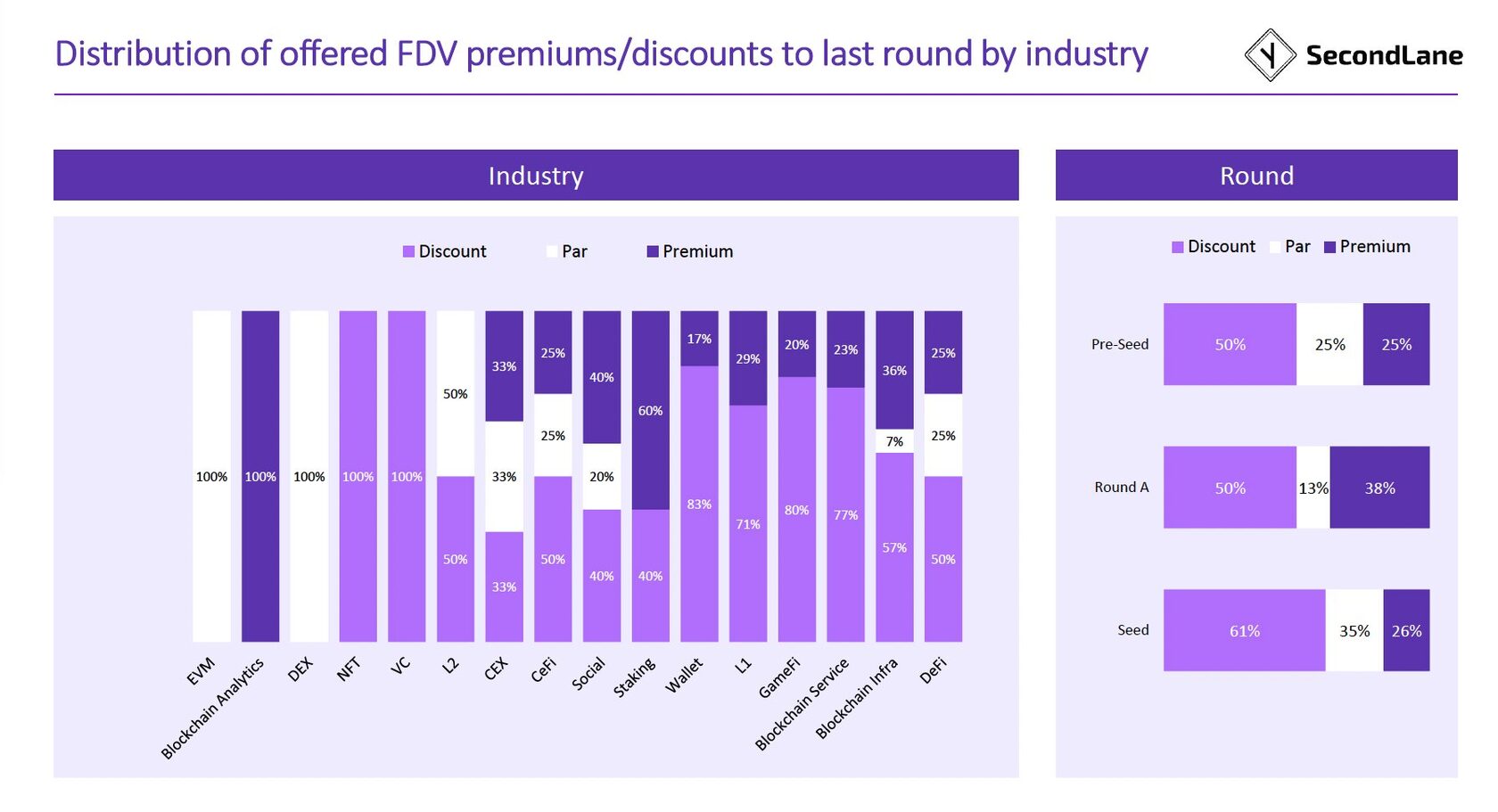

- largest discounts for NFT, wallets, L1, GameFi, Blockchain services and infrastructure projects

- largest premiums for projects in blockchain analytics, and staking

- largest premiums for Round A, largest discounts for Seed Round

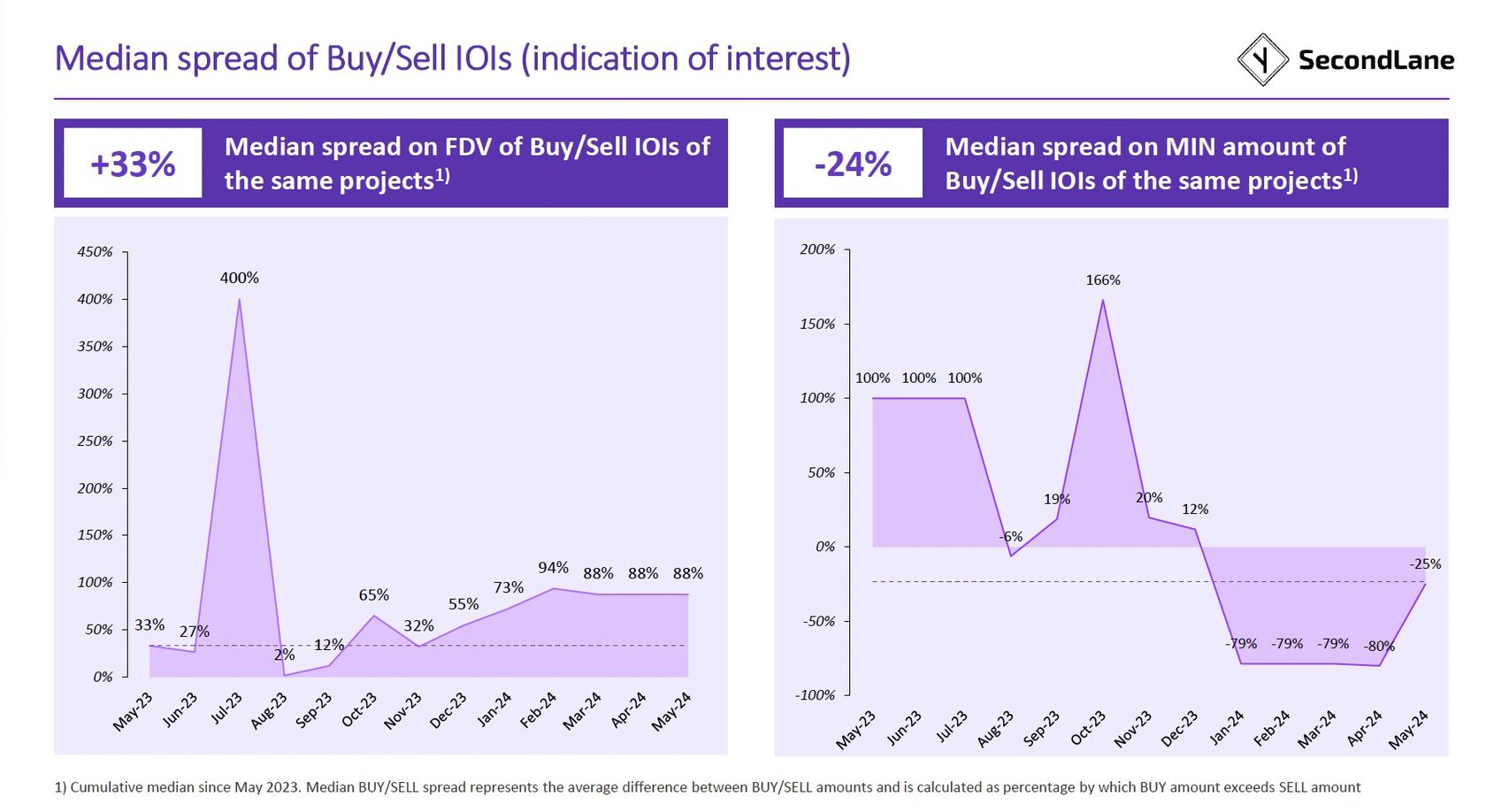

- buying offers continue to stay at +88% premiums to Sell opportunities

- at the same time average minimum Buy/Sell bid size spread grew from -80% in April to -25% in May

- 13% of deals circulate without public exposure, with a lower valuation ($3.9B FDV vs $6.9B FDV on public offers)

- most private deals came for SAFT (82%) at (Pre-)Seed stage (83%) deals for DEXes, EVM, and L1

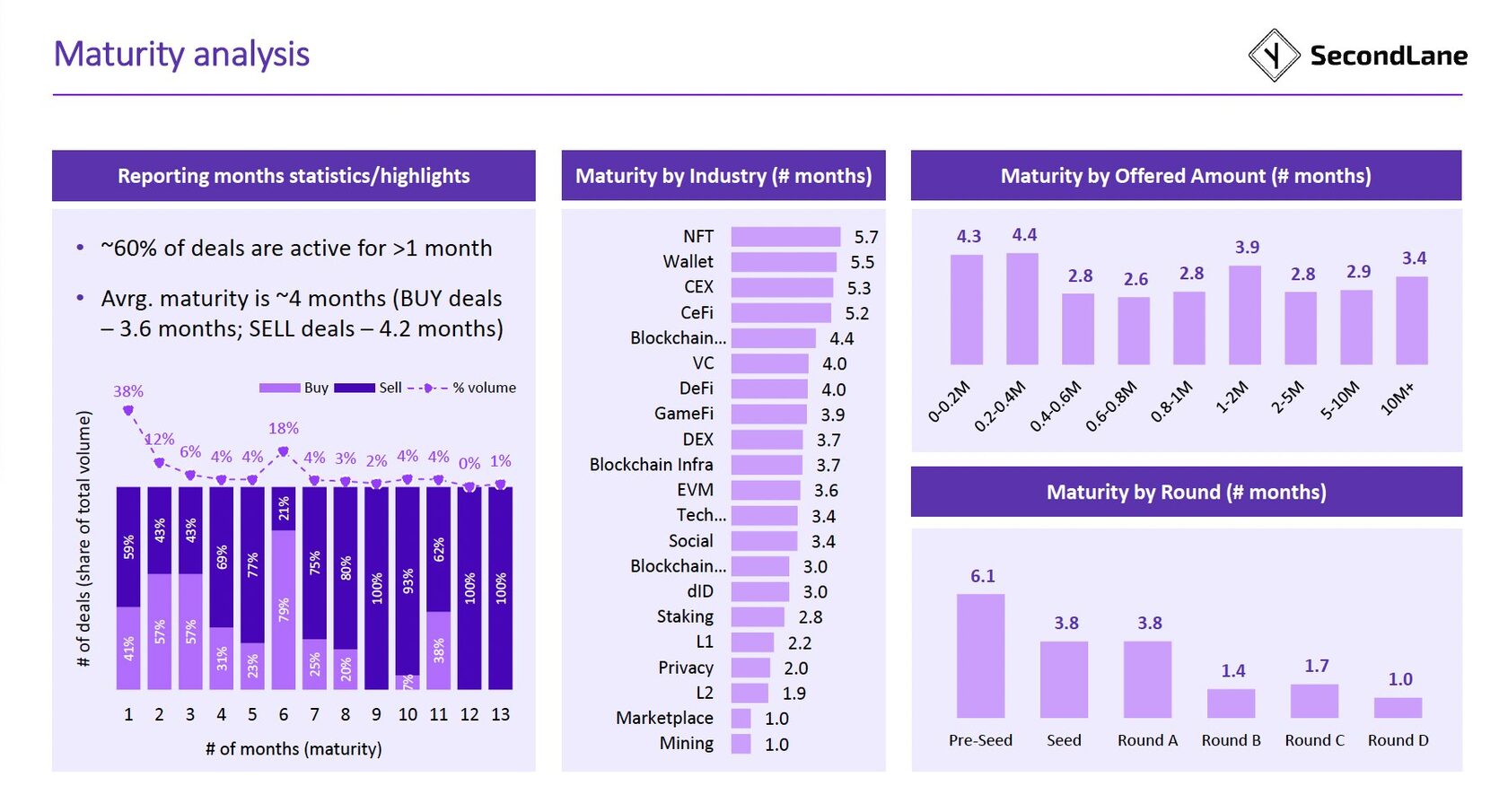

- average deal maturity grew to 3.6 months on Buy Asks and 4.2 months on Sell offers until expiration or transaction

- 62% of deals are active for over 1 month

- longest maturity among: – earlier vs later rounds: 6.1 months for Pre-Seed; 3+ months for Seed & Round A vs 1+ months for Rounds B, C, D

– NFT, CeFi, Wallet, CEX projects

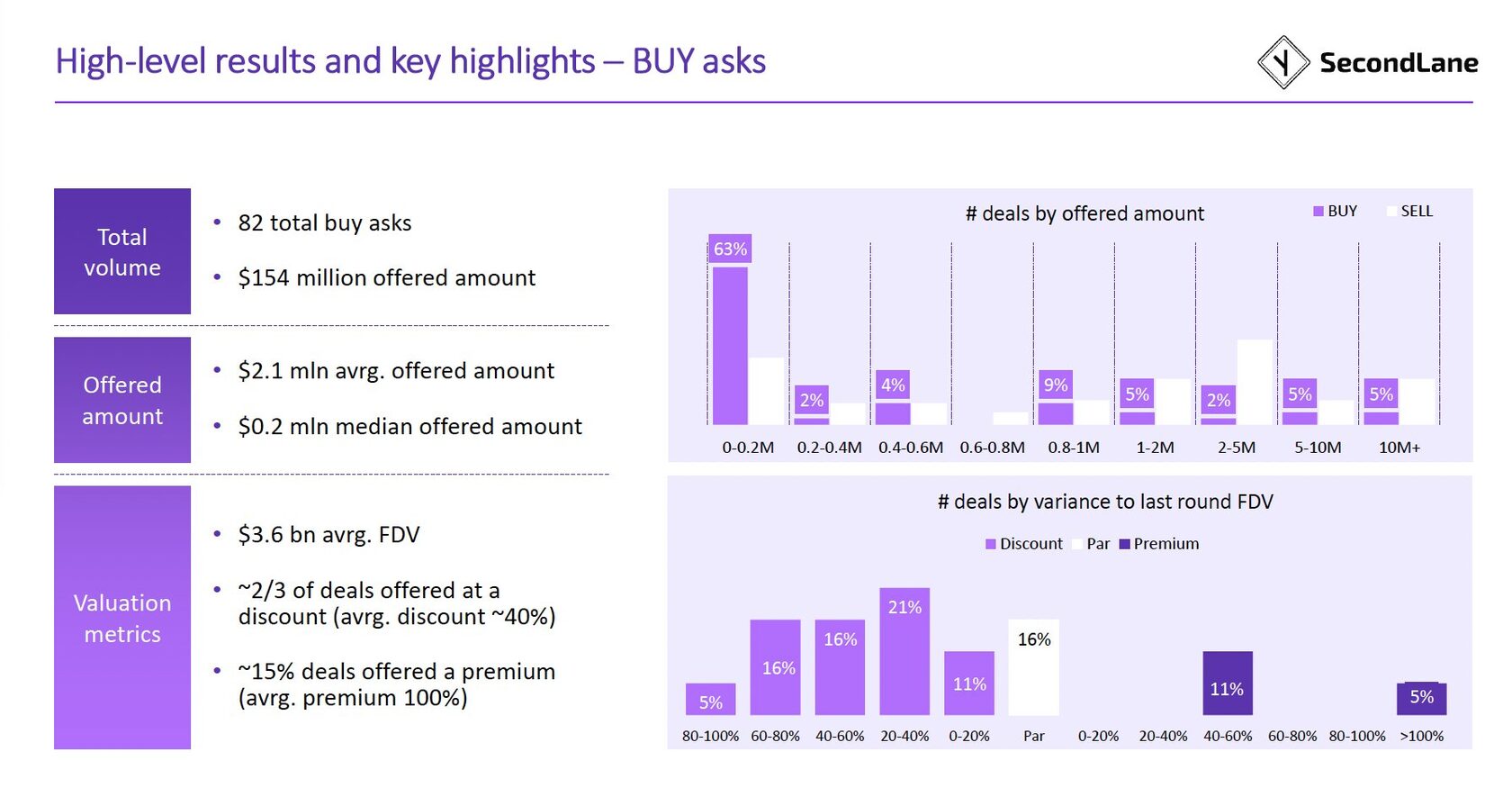

- $200k median Buy Ask at an $3.6B average valuation

- 2/3 of Buy Asks come at discount (40% avg discount to last round or spot); 16% at par; 16% with average premium of 100%+)

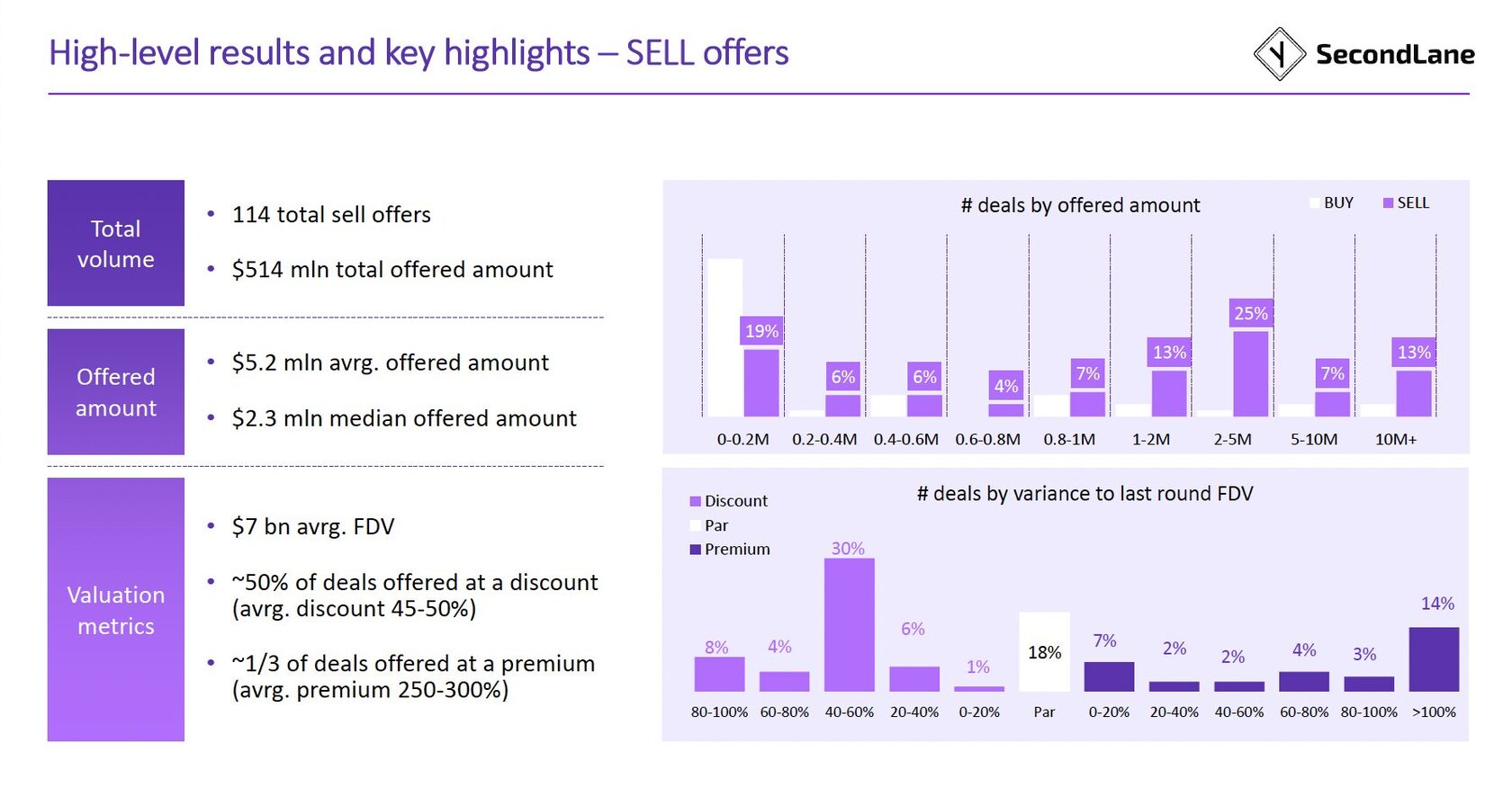

- $2.3M median Sell Offer at $7B avg valuation

- 49% of deals offered at discount (45%-50%); 18% at par; and 33% asked for a premium (avg 250%+)

Reach out to us if you wish to receive the full May 2024 secondary market report in pdf